Watch your supplyside

Excess attention on the Fed is a distraction

9.1% CPI

Synopsis: Everyone is talking about the Fed and rates. Nobody is talking about legislation which could fight inflation. Foreseeing potential changes to the supply side equation may be useful in asset allocation.

Pretty unreal number and likely one that will increase calls to action. It’s hard to predict a tipping point (a moment which pushes people over the edge and leads to dramatic action)…but 9.1% seems like the type of number which could do it. Put the number to the side for a moment and think about what could lie on the path ahead.

The two competing schools of economic thought are demand side and supply side economics. Demand side or Keynesian economics basically states that to control an economy you need to either stimulate or curb demand. This is most effectively done by using central bank interest rates, along with other forms of economic stimulus (such as QE/QT — which is the purchasing of financial assets or selling of said assets to infuse or withdraw cash from the economy).

Unless you have been hiding in a cave with no internet for the past 6 months, the only thing you’ve heard about on CNBC is the Fed raising rates and possibly sending the economy into a recession. You’ve likely heard numerous critics blame the Fed for not tightening sooner, and that the excessively accommodative conditions are the cause of the rapid inflation we are seeing.

I’m not going to attempt to dispute or prove that theory. However as I prepare for my exam to become an Enrolled Agent (IRS’ tax expert certification path)…it made me think about ways in which legislators may have tools which can assist the Fed in bringing down inflation….tools which they have not used. This is supply side economics, and it’s worth keeping an eye on while the rest of the world watches the Fed.

To begin, I’ll state what should be obvious. A big portion of the inflationary spiral we are in is directly related to Energy prices…and this is a consequence of Russia’s invasion of Ukraine. This impacts the cost of transporting goods, such as food. It also impacts the cost of making critical raw materials. Any change in energy prices will have a large impact on overall inflation.

However in terms of energy…there is little meaningful, short term action which can dramatically change the costs of energy overnight. So I won’t waste time discussing it.

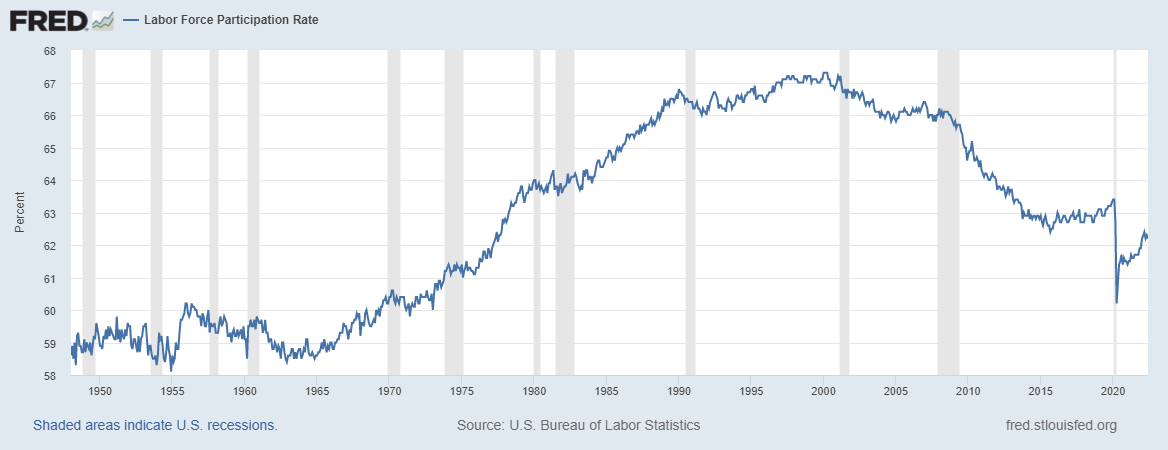

The second less obvious factor driving inflation is wage inflation caused by a tight labor market. The labor market’s influence isn’t as apparent as energy, but it is a meaningful factor. The largest expense for most companies is the salary of their employees. Without sufficient workers, you can’t package, ship and stock sufficient product…which leads to scarcity…which leads to price increases.

This is one particular area in which legislation can make a direct impact by either increasing the labor pool (via Immigration Policies) and/or incentivizing ‘discouraged workers’ (people who give up looking for a job and therefore are excluded from the unemployment figures) to get back in the labor pool. Specifically they can target certain fields like truck drivers, new home construction, etc. with tax incentives and credits which could be key to attracting workers into these fields. These incentives don’t necessarily have to go to the employers…they can be passed directly to the employees via legislative action, the same way credits are passed for college education, electric vehicles, etc.

There are other actions that the Legislative Branch could take to influence supply, particularly in housing. Rent was up .8% in the latest report. That is the highest increase since April of 1986. It would be easy to say the the increase is just a product of tight supply, but in all likelihood it’s at least partially in response to the increased cost of financing the debt on these properties.

However the only solution to the cost of financing, is lower rates and with high inflation that is off the table. Housing has a somewhat inelastic demand curve. So it’s hard to destroy demand, and doing so would likely bring meaningful repercussions to society as a whole. This means the most obvious solution is increasing supply. Besides increasing the worker pool through legislative action, legislators also have tools which could increase the supply of housing by making it more costly to sit on vacant and underused properties. To understand this, we need to first look at current law, and how these can be exploited for tax benefits.

Imagine you rent a condo out on AirBNB for 100 days of the year. However you use the condo for 2 weeks (14 days) on vacation with your family. At the end of the year, AirBNB submits a 1099 to renters on it’s platform (either 1099-K or 1099-MISC). Yet there is no requirement for them to submit the actual days which the house was rented out on either form. Why is this important?

According to tax law because you used your condo for 14 days…you can only legally allocate (100/365)% of your expenses (utilities, depreciation of property (not land), insurance as business expenses. The rest are considered personal. Let’s do some math.

For simplicity sake we will assign the total expenses a value of 3k per month or 36k yearly. In this make believe situation assume your property rents for $180 per night or 18k in total revenue.

By law your business expenses should be 9.8k dollars (100*36000/365), so you would recognize a profit of over 8k dollars. However tax law assumes that people both know and respect these laws. From my experience, in most cases, one or both of these will not be true. People either don’t know, or don’t care, or at the very least will disregard proper tax law for the convenience of less taxes if a friend feeds them misinformation.

One way around this is claiming that you did not use the property for personal use. In fact a vacant property when not used for personal purposes for >14 days can be claimed as entirely for rental use…and the expenses would generate a passive income loss, even if nobody lived in it at all during the year.

Of course this passive income loss can only offset a passive income gain. However if you have passive income such as income from a Limited Partnership or royalty income…why not offset it with a passive income loss and arbitrage the tax benefits to increase the equity in the property?

How could legislation change this? One way is by completely disallowing expense claims on vacant properties, or the IRS could make platforms like AirBNB disclose the # of days the house was in use. They could disallow Passive Income Losses from Rental Properties to be used against Passive Income from other sources. They could differentiate vacation rentals from SFU rentals and create a whole new set of rules. In other words, there are a number of tools at the disposal of federal and state legislators to make holding underused rental properties less attractive. Would they do it?

That is the million dollar question, and it’s one that nobody is asking…because we’ve all been so focused on demand side, that nobody is watching the blind side…the supply side. It’s worth noting that Chair Powell has been vocal in reminding Congress that they alone have the power to enact legislation. Perhaps he will start to be more vocal about tools they could or should use in the coming weeks or months to alleviate pressure off the Fed.

Of course all of this depends on having a functioning legislative branch of the government, which is a major assumption given the past decade of results.

But if we keep getting CPI readings like this one…they may not have a choice as consumers will demand action.

What it means for investors:

Don’t assume that rental property/rental property companies are bulletproof because they are inflation resistant. Calls for legislative change could change the equation quickly, and the likelihood increases with each print.

Homebuilders, Transportation could be a target of potentially favorable legislation in an attempt to increase labor supply.

Consider potential federal and state legislation when analyzing REITS or other rental/vacation rental investments.