The "B" Word

The thing about Bubbles is that they are easier to see in retrospect then in present time.

The past year has been a boon for stocks, with artificial intelligence (AI) companies leading the charge. NVIDIA's stock price has skyrocketed, while tech giants are pouring resources into AI development. It's a gold rush, and investors are giddy. In fact I found myself increasing tech exposure in my own portfolio this week. However a look at the data makes me wonder if maybe we aren’t starting to enter a period of irrational exuberance.

One of the hallmarks we tend to associate with market bubbles is an insatiable risk appetite which evidences itself in speculative investments. However the current market strength is being driving by companies who are generally all financially strong. Over 10% of the companies S&P 500 are up nearly 25% YTD. Because of this, it would be easy to just overlook what’s going on as just a typical bull market.

Furthermore AI does have the potential to revolutionize society. It's a compelling narrative, and it's easy to understand the hype, especially given how meaningfully Tech grew 10 years post the Dot Com burst. But there are a few factors which deserve consideration:

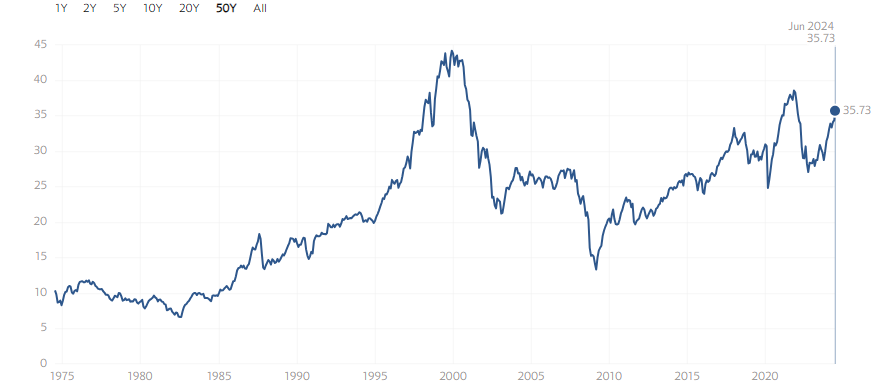

Soaring Valuations: Here’s the data. Currently CAPE ratio is at a whopping 35.73. While significantly lower than the Dot Com Bubble, and about 10% off the SPAC Bubble, it’s still 2x the average Ratio (Mean 17.13, Median of 15.98) and far above the typical range of between 10 and 25.

FOMO (Fear Of Missing Out): Historically a 15% pullback takes place every 216 days when using the median average and 584 days when using the mean average (which was heavily skewed by a nearly 7 year bull market between 2011-2018). We currently see that it’s been 631 days since a 15% drawdown.

Selective Hype: While most have been mesmerized by AI and GLP-1 names, the reality is a number of swaths of the market has done well. Here is one factor that binds the winners together, Momentum:

It’s impossible to ignore the way momentum has outperformed over the past year. It’s simply blown away the rest of the market.

So let’s review what we’ve seen:

Valuations are elevated

We’re 50 days over due a draw down in an extreme environment, 400 days over due a draw down in a more normalized environment.

Momentum stocks are blowing the rest of the market away.

Should we be using the ‘B’ word to describe the current market? Not saying we can’t run higher, in fact I suspect we will. However it’s hard to ignore the evidence which suggests trouble could be brewing on the horizon.