Nano-influence and the Ownership Economy

On a long enough time horizon...everyone sells ads.

Perhaps you’ve heard there is a Fintwit conference going on in the not so distant future (emphasis on twit)…I’m assuming after writing this I won’t be invited…unless of course I was willing to spend money or change my viewpoint on companies with terrible business models. Inspired by this conference, some of the commentary I’ve read on it, and my own experiences recently…this is a post about the influencer economy , why it will both fail and succeed…and what I see as a potential outcome…a world where everyone is an owner and an advertiser…and a twit.

Humans are smart…well most of us…or at least people like you, dear reader (is my flattery working?). For most of us, when we see an ad, it doesn’t move the needle significantly on our purchasing decisions. A sale or a discount does, but for a company, those are profits being given away on the chance that we will generate future profits by buying again or adding on goods and services.

Advertisers know that the single biggest thing that moves the needle is a product recommendation from a trusted source. Companies for decades have tried to buy credibility.

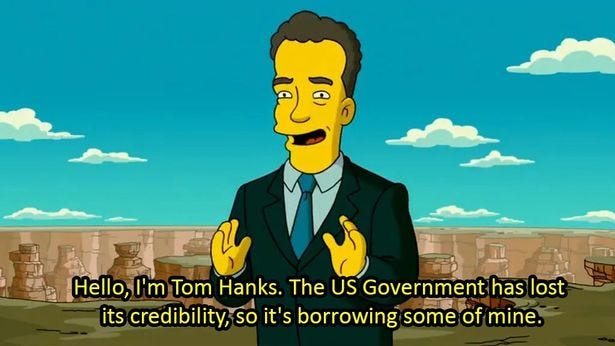

This scene from the Simpson’s sums it up brilliantly. Everyone is trying to buy credibility. Economies are built on the back of trust. No trust, no economy. Proof of point — look at how the Fed floods the market with liquidity as a response to any financial crisis. What they are trying to do is built trust. Trust that lenders will be made whole. This keeps the economy working. No trust = No economy.

In the past decade, social media has helped companies come up with a new way to buy credibility. Influencers. These are accounts with large numbers of followers who subtly or not so subtly push products on their followers. It can be financial products, services, beauty supplies, crafts, sports, etc. If you name it, someone is promoting it on social media.

Sometimes they will use the phrase “Brand Ambassador” to white wash what’s going on…but we are too smart to be fooled. It’s product pimping, plain and simple. Over the next decade, I expect we will see more and more.

However this leads to a problem.

Going back to Fintwit.

No doubt many of you are tired of hearing of guru’s pumping piss poor stocks and charging for newsletters to hundreds of thousands of followers while claiming how they can teach anyone to be a millionaire.

Why anyone who’s making millions on their stock trades would want to give away the secret sauce is beyond me. Seems you would want to keep your successful strategy a secret until you were a billionaire.

I guess selling newsletters to regular Joes is more profitable.

As proof of the environment we are in, the SEC has actively gone after some individuals who’ve promoted microcap stocks in pump and dump schemes, and I wouldn’t be surprised if more indictments follow. When CEOs are giving interviews on Twitter to “retail investors”, that should signal a problem. A company only benefits from it’s stock price in that it gives it the power to raise more equity and to get access to cheaper capital. In other words, to dilute its owners.

Owners of the stock (executives, employees, shareholders and fintwit influencers) are benefitted far more by a sudden rise in a stock price. The more a CEO is in front of a camera, the less focused they are on the day to day business they are tasked with running.

These types of actions, not just in the financial markets, but in products and services too, is leading to an environment of distrust. When you know the influencer is getting paid buckets of cash to push a product…you don’t view them any differently than a sales person. What really makes or breaks an influencer isn’t their reach…it’s the trust that they have with their followers. If followers trust someone, they will allow themselves to be influenced.

Wall Street doesn’t have trust because they flushed it away during the Great Financial Crisis. That’s opened the door to places like Reddit and Twitter to become sources to find trustworthy opinions and to be fair, there are great accounts who genuinely have earned the right to be respected and trusted.

Large companies like GM, Exxon, McDonalds and Dupont don’t have trust, because they’ve poisoned the planet and/or our bodies in a chase for cash. Influencers are heading down this same path of trading trust for cash. If you keep pimping and pushing a product…people aren’t dumb. They will figure it out. Inevitably that’s a bad deal. Warren Buffett didn’t amass his wealth just by making shrewd business deals. People dealt with him because they knew he could be trusted.

So how can a company promote their product without trading trust for scale? There is a paradigm shift happening. Google search micro-influencers and you will see that companies are now actively seeking out accounts with between 1k and 100k followers. Why? One influencer with 1M followers, and 10 micro influencers with 100k followers have the same reach. But the less followers you have, the less likely people are to identify you as an influencer. And the less the company has to pay you.

It’s in this logic, that I personally would like to make a prediction. In the next decade, businesses will move from micro influencers…to nano influencers. Accounts with between a few hundred and a few thousand followers. Why do I believe this makes sense?

The less a person knows they are being influenced, the more likely they are to trust the recommendation.

If I post a picture with my family drinking cokes, and I tag @coke, none of my friends will think I’m an influencer. But if they are at the store, they might remember a 12 pack. In fact, I’ve been told by peers that my tweets have influenced them to try certain services I use (Disclaimer: I got absolutely 0 compensation for it).

I would dare to say that having an army of nano influencers makes even more sense for a business when you consider the possible incentive structures they could design. Imagine, for instance, if a business offered fractional equity goals to it’s influencer teams. Now you’ve done more than create an army of mercenaries…you’ve created an army of owners. This to me, is the big opportunity that the market hasn’t quite yet realized.

Look at Gamestop and AMC. While I firmly believe these are both bad businesses (AMC more than GME). I do think they are a glimpse of the future of business. They’ve created an army of owners. Nano influencers who will not only promote the product…but probably create excuses to use it as well. Maybe you’ve done this…you own stock in a company…you have to make a purchase…where do you purchase from…

All things being equal, you buy the product from the company you partially own.

It’s Peter Lynch economics…own what you know and use.

If Coke could get every person in the US to own 1/2 a share of Coca Cola…what do you think that would mean for Pepsi?

I’d venture to guess it wouldn’t be good news.

This is my big idea.

This is the big trend I see coming.

A wave of nano influencers and companies using fractional amounts of equity to create ownership mentalities. Blockchain smart contracts, digital wallets like Cash App, Venmo and Robinhood, and social media platforms like Instagram and Facebook make this possible. Everyone will own bits and pieces of their favorite companies…and that is the ultimate moat.

Maybe it never materializes…but if it does…then @modestproposal1 would have proven clairvoyant when he said: