Game plan for 2024

Reflecting upon 2023's best and worst. Game planning for 2024.

2023 was a year of feast and famine for me personally.

I had some big winning ideas including going short a couple of the banks that eventually went to 0. But no investment paid off better than my investment in Facebook.

I had some big losing ideas such as going long consumer discretionary and personal credit after the sector had taken a bath, only to watch it take a further bath. I also bottom ticked a disastrous short in Coinbase, and didn’t exit my Tesla short quickly enough to turn a nice profit.

For the year I’m flat with a caveat…I have a substantial portion of my portfolio in defined outcome UITs. As these are less liquid, they trade at a discount to their current liquidation value. If these liquidated today, I’d be slightly positive for the year. Nevertheless not the outcome I was targeting in a year where the Index is up big.

Lessons Learned

My best investments were ones where the economics of the companies were so clearly out of line with the stock price that the result seemed nearly inevitable

Any investment where the result wasn’t a near certainty seemingly went against me

Perhaps then the key takeaway for 2024 is to not take so many fliers. In fact this has probably been my key takeaway for years. As I write this up, I just took two fliers on a couple of names which I think have 10x or greater potential based on special situations, but in both cases I feel the asymmetry is closer to my first lesson than my second.

Looking Forward

As I look towards 2024, here are a few ideas I’m looking for ways to invest in.

Small Caps Could Lead Out of Correction.

If rates are in fact going to be cut, I like the idea of being overweight small caps. To hedge my risk, I’ll play in Small Cap Value by owning a Fund with a good record of outperformance, and a manager who’s highly incentivized to be right.

Mega Caps Regress to the Mean.

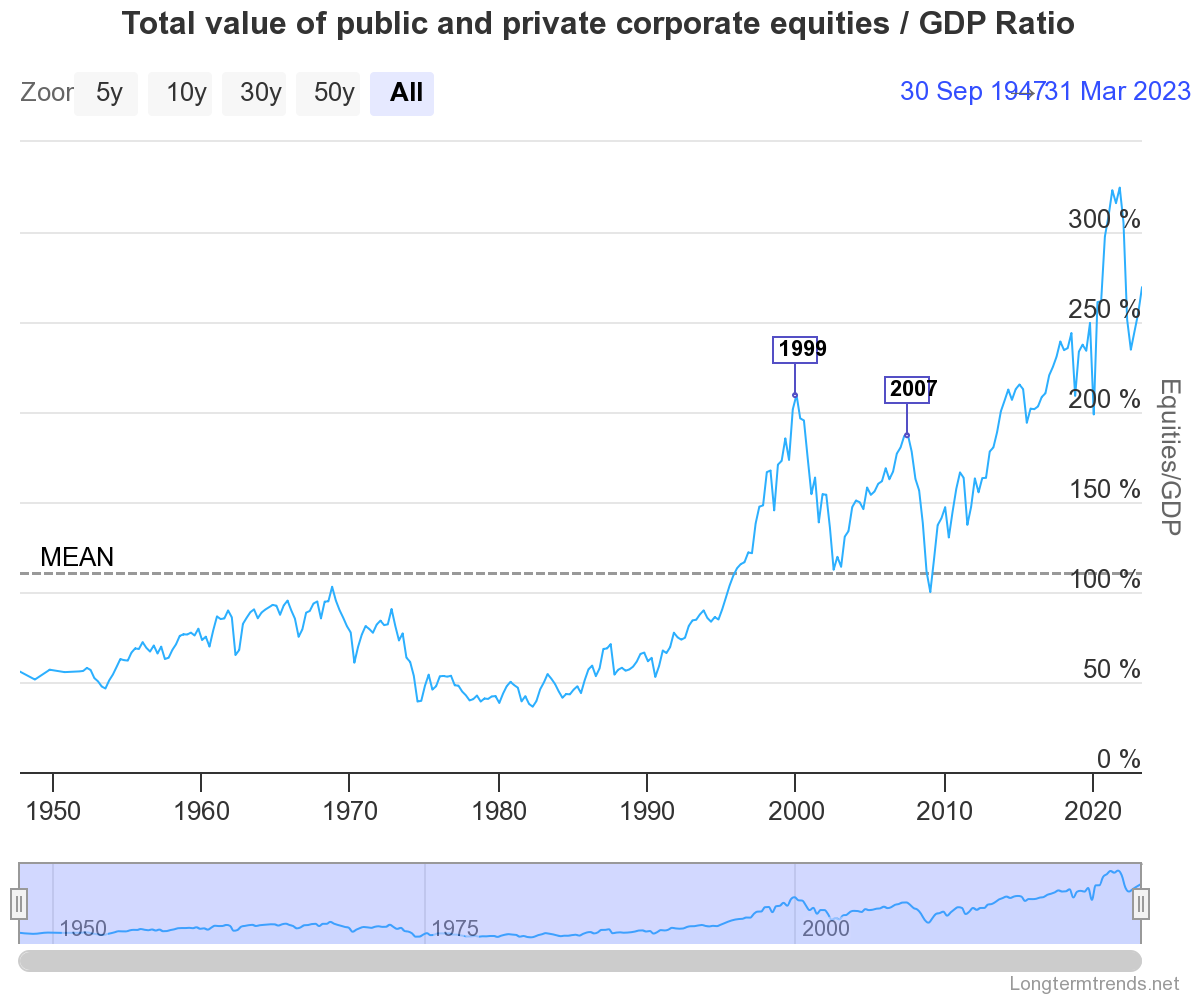

If you look at the markets performance this year, it’s been the largest of the mega caps that have driven a bulk of the gains. That isn’t sustainable. The math doesn’t math. The graph below highlights why. The values of equities to GDP is still at a higher level than seen even during the dot com and GFC eras. When margin expansion reverts to the mean, you could see a large hair cut on all of the mega caps which make up a bulk of the margin expanders. YPS is a reverse SP500 index fund which I think looks interesting. An equal weight fund is another way to play it.

A Meaningful Corporate Debt Wall

Bankruptcies have accelerated in the past 12 months. Commercial real estate has shown distress, banks have shown distress, and a number of zombie companies have already gone bankrupt. This seems like the type of environment where smaller distressed debt funds can deliver outsized performance. I’m looking for funds that have few restrictions coupled with managers that have skin in the game.

A Surging Dollar in Asia

The dollar has been surging in Asia against a number of currencies. This means it’s a good time to be able to buy Asian equities with U.S. Dollars. I don’t know much about the space, so I’ll be looking to find fund managers with the right incentives to invest with.

Watching Municipal Bond Yields

If last night was any indication, Democrats may do well in 2024. Given the path laid out in 2022 to increase government spending, and fund it via the IRS, logically it seems Municipal Bonds could see increases in demand. Especially if rates remain higher for longer, or start falling. I’m not particularly interested in the space, but for an active bond trader OR high net worth investor, this may be a space worth watching.

Staying Short Tesla

If I’m bearish mega caps, I’m even more bearish the ones with no rational investment case outside of hopes and dreams. Especially with mounting legal and economic woes.

Dumpster Diving/Special Situations

Baby’s get thrown out with the bath water. In the past 3 years we’ve had so many SPACs, IPOs, Spins and Mergers that it might be time to start sifting through the rubble.

Speaking of Mergers, SAVE 0.00%↑ looks extra tempting right now. The fact that it’s a cash value per share added with a weak DOJ case, suggests an option play could have a massive payday ala Twitter. Unlike AMZN 0.00%↑ acquisition of IRBT 0.00%↑ this one won’t have to clear EU.

I started writing this article on Monday 11/13 before the market started to rally on soft landing hopes. Russ 2K and QQQ have both outperformed SPY which is somewhat to be expected. It will be interesting to see if we get a Santa rally this year, or if Christmas has already come early for investors.