Etsy Deep Dive..

Keeping Commerce Human

Hey everyone,

Thanks for taking the time to review my deep dive into Etsy (ticker: ETSY). Let’s start by taking a brief overview of the business:

Etsy operates two-sided online marketplaces (Etsy and Reverb) that connect millions of passionate and creative buyers and sellers. Their primary marketplace, Etsy.com, is the global destination for unique and creative goods. The Etsy marketplace connects creative entrepreneurs with thoughtful consumers looking for items that are intended to be special, reflect their sense of style, or represent a meaningful occasion (think weddings, birthdays, holidays). Their technology platform allows sellers to turn creative passions into economic opportunity.

They also own Reverb which is a global online marketplace dedicated to buying and selling new, used and vintage musical instruments. Given that Reverb is a tiny portion of the Etsy business, we will focus our deep dive exclusively on the Etsy.com marketplace.

Business origins and model

For more on the Etsy origins, check out this story from CNBC.

Etsy was launched in 2005. In it’s first year it reported $1 million in gross merchandise sales (GMS — Etsy’s key metric). By 2019 Etsy reported that number had grown to $5 BILLION. Founded by Robert Kalin and a group of friends, the Etsy vision was to reimagine commerce to build a more fulfilling and lasting world. The company has always had a social mission since it’s very founding. As the company grew Kalin was eventually replaced as CEO by Chad Dickerson. In March of 2015 Etsy went public. The stock did not do well as Etsy performed poorly after going public. This eventually led to current CEO Josh Silverman replacing Dickerson. The turnaround has been astounding. In May of 2017, ETSY stock was trading for under $15 per share. It recently hit over $150 per share and is now trading around $130. That’s a near 10x return for those who bought in early under Silverman’s regime.

At the end of it’s first year Etsy had about 9,000 sellers and 22,000 buyers. As of December 31, 2019 it now has 2.7 million sellers and 46.4 million buyers.

Etsy makes money via it’s seller friendly platform. They do not charge a fee to open a shop. Each listing costs .20 and lasts for 4 months or until the item is purchased, at which time the list can automatically or manually relist for .20. They also take a transaction processing fee (3-4%). They charge a sales fee for a cut of each sale (5%). They offer on platform advertising (seller sets his/her budget) and they offer shipping labels as well. In addition they’ve recently launched Pattern by Etsy which is a monthly fee that allows a user to secure a domain name and create a site that’s linked with the Etsy site, but that also allows them to have listings not on Etsy and have greater control over layout and content.

Growth numbers

The charts below are based on information from CNBC, Etsy’s S-1 and Etsy’s most recent 10K. You can see that the growth of buyers has far exceeded the growth in the number of sellers. This is important in the health of the business as oversaturation of sellers to buyer could result in Etsy losing key sellers.

You also can see that Gross Merchandise Sales has continued to grow at a staggering pace. From 1M to nearly 2B in 9 years, to nearly 5B in the past 5 years.

As a result, Etsy has grown total revenues at a near parabolic pace. The pandemic has only caused an acceleration in Etsy’s revenues:

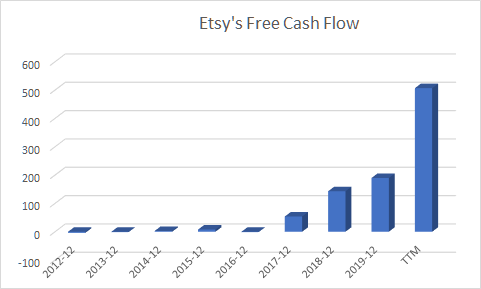

And finally you see that Etsy has reached a scale where it is Free Cash Flow positive

What does remain to be seen is whether they can maintain this elevated level of Cash Flow after the pandemic.

TAM and Moat

Etsy management believes it’s total addressable market is at least 100B but possibly could expand to over a trillion. Considering they sell clothing, jewelry, party supplies, décor and furniture, 100B seems low for it’s TAM.

Etsy does have a number of moat like qualities. They clearly have a first mover advantage in the niche e-commerce marketplace. They also benefit from having network effects. Sellers that open a shop normally spread the word to friends and family, driving new buyers to the platform. Social media posts spread the word even further and the network effects extend and become even more powerful.

They also have an advantage over other large platforms like Amazon in that Etsy allows communication between buyers and sellers/makers of the product. This builds brand trust with the sellers on the platform and increases Etsy’s value add to the buyer. The large number of buyers available to a relatively small number of sellers makes the platform sticky to users who may otherwise be tempted to bolt from Etsy to a Shopify, Big Commerce or Wix style website which would lower overall transaction costs for larger shops but at the risk of losing millions of potential eyeballs.

While this is still a risk, Etsy may be preparing to address this risk by adding Pattern by Etsy, a website and domain service. While this offering is still in it’s infancy, I suspect over time it will come to mirror Shopify in it’s monthly fee only model for use by larger Etsy shops. The added advantage of course being that users have some integration with Etsy’s massive network of buyers.

Management

One of the biggest reasons I’m bullish on Etsy is the CEO Josh Silverman. I’m not as sold as most on the value of a founder led company. While it can have value, it can also have significant issues. Silverman is intelligent with relevant experience. Having founded Evite, led eBay and worked with American Express he understands many of the core businesses that Etsy operates in. The board experience also is very relevant with the CTO and another board member having experience working with PayPal.

Management appears to be extremely transparent. They are one of the few companies who explicitly lay out how they calculate their total addressable market. During the pandemic they held an investor update to lay out challenges they were facing and even amidst the surge in buying of masks, they’ve detailed exactly how masks have been a one time inflation of sales, breaking out the section and clearly showing how masks have decelerated over the pandemic and making investors aware of how those may skew models. During their conference calls they lay out advertising strategies and other things which other companies do not do.

Opportunities in the Future

Etsy still has revenue levers they can pull. In addition to growing awareness of it’s platform, Etsy currently does not do anything to directly monetize essential business operations such as inventory, accounting and taxes. These may be other growth market opportunities.

Etsy could also create a secondary focused website. For example, Etsy currently has bakers selling baked good. Etsy could decide in the future to create a handcrafted food websites (Foodsies.com?). They could use the insights they have learned from Etsy to create other niche markets which may benefit from a separate platform (like Reverb).

Etsy now has an option for shop owners to allow customers to know when they will be selling locally. Etsy could potentially do some things to monetize popup opportunities especially in a weak retail environment.

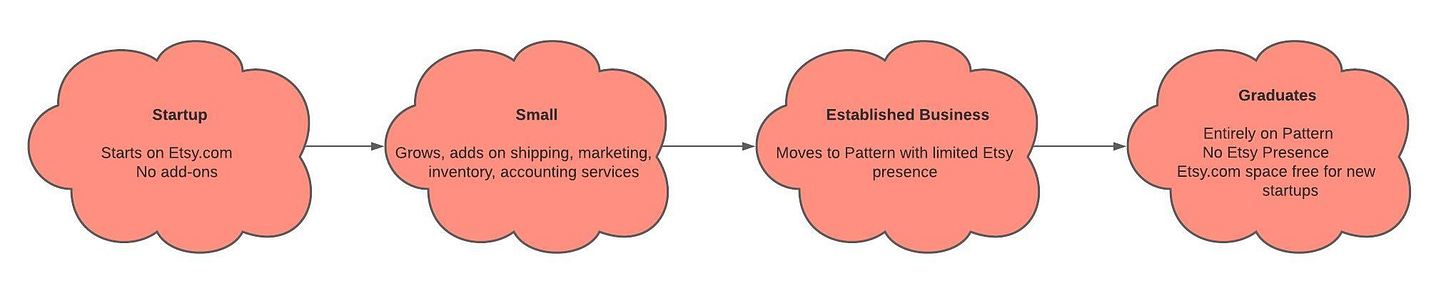

Finally Pattern by Etsy may be potentially their greatest revenue opportunity in the short term. It offers something that could help retain larger stores, while offering more steady revenues and potentially freeing up visibility in it’s Etsy.com marketplace for smaller stores with different offerings. This diagram visualizes what I see as the future life cycle goal of an Etsy shop.

It grows on Etsy before transitioning eventually to an independent business entirely on Pattern. This would offer benefits to both Etsy and the independent shop by allowing both the room needed to continue to grow their respective businesses.

Concerns:

The only concerns I would have about Etsy in the near term are the valuation relative to other E-Commerce platforms like Amazon and eBay. On a sales basis Etsy is valued at 2x what Amazon trades at, and 4x what eBay trades at. It’s worth noting that the Etsy has a much better margin than Amazon, so in comparing valuations this is something to take into consideration. I’d prefer to see Etsy trading at an 8-10x sales margin as opposed to a 12x sales margin. However it’s not exorbitantly priced to beyond perfection like many of the hot growth stocks on the market at the moment.

Also Etsy will have to be careful to balance out buyer growth, seller growth and concentration of revenues in larger, established sellers. Investor Relations confirmed that historically about 80% of GMS is being generated by about 20% of sellers. Any increase in this I would view as as a threat to the business since a diverse platform of goods is one of the moat like advantages that brings buyers to Etsy. While this isn’t a number they breakout, it would be a good idea to monitor seller churn. Etsy may need to do more to keep it’s sellers happy as it continues to monetize and grow.

The biggest competitive threats to Etsy may come for social networks like Instagram, Pinterest and Facebook. As these platforms start to develop sellers tools, they could eventually take share from Etsy. The key for Etsy is to get big as quickly as possible. So far they’ve done this successfully. Because of this I’m long Etsy and will continue to look for 7 to 8% drawdowns as buying opportunities in the near term.

Hope you enjoyed this read. Feel free to share this research with a friend and/or sign up for inbox notifications on all my deep dives and quarterly updates.