Elon's 10%

A look at the numbers from the most recent Proxy Statement

Elon Musk sure manages to stay in the spotlight. To say the least, the man should win an honorary Doctorate in Social Media Marketing/Management. This is his latest gem:

In it he promises to abide by the results of the Twitter Poll (currently 57% have voted YES).

What could this mean for Tesla shares? A look at his numbers based on the latest Proxy Filings

Tesla 2021 Annual Proxy -- Ownership Securities Section

As of 6/30/2021 Elon Musk is by and large the biggest holder of Tesla shares with 244M shares held, or 23.1% of the company.

Per the footnote 170M of his shares are held in a trust account and 73.5M are options which have not been exercised and are eligible to be exercised. Of the 170M shares 88M are used as collateral to secure loans (he borrows off his wealth to avoid selling and realizing capital gains).

Tesla 2021 Annual Proxy -- Outstanding Equity Awards Section

Entering into 2021 he was sitting on 56M shares which are exercisable at any point. Since then he achieved two more milestones worth ~17M more options bringing us to the previously mentioned 73.5M options #. However these options have different expiration dates (the date by which he must exercise or forfeit the option).

Options for 22.8M shares expire on 8/13/2022

The rest expire on 1/19/2028

He also could potentially earn up to +50M more shares by achieving the necessary performance awards…for simplicity sakes…I will not discuss these.

How much is 10% of Elon’s Shares?

So the answer is…it depends. When Elon says 10%…is he talking about 10% of his shares including options…or excluding them.

Excluding Options:

170M shares / 10 = 17M shares to be sold

Including Options:

244M shares /10 == 24.4M shares to be sold.

If he is in fact including options…is it fair to assume that with 9 months til expiration…he is planning on exercising his 2012 compensation options?

If so then this certainly was a brilliant marketing ploy.

Because he would have had to realize a capital gain on them sometime within the next 9 months.

Scenario:

This is a scenario for what could happen if Elon decides to sell 24.4M shares mostly made up of the 22.8M shares from the 2022 expiring lot.

As of 6/30 Tesla had 984M shares outstanding…so 24.4M represents about 2.5% of float. Not a huge number.

Let’s assume the stock opens down in line 2.5%

Looking at the options market…using delta hedging as a proxy for options hedging…right now options market makers are sitting on about an excess of 3M shares…a sudden 2.5% move downward from the dilution caused by Elon’s exercising and sale would move that number to about 12M. So assume they sell another 9M shares…it’s fair to assume that’s good for another 1% move.

Let’s look at the other major shareholders

Vanguard and Blackrock aren’t selling because they hold shares in Index Funds…so the only way they sell is their are redemptions on their SP500 index funds.

The next largest institutional holder is the Capital Group who also owns about 5% of all of Tesla.

Do they get spooked out by the possibility of Elon, Kimball, Antonio Gracias, Robyn Denholm (current chairperson of the board) and Ira Ehrenpreis all selling in rapid succession? If so…how spooked?

I would assume that even if they did…they would likely trim and not cut to 0. However if they trim 20% of their stake…then you could see another 1% move in Tesla.

So possibly a 4% move assuming a rational, calm market with no panic selling/buying by retail (definitely a risky assumption)

One last group to know…

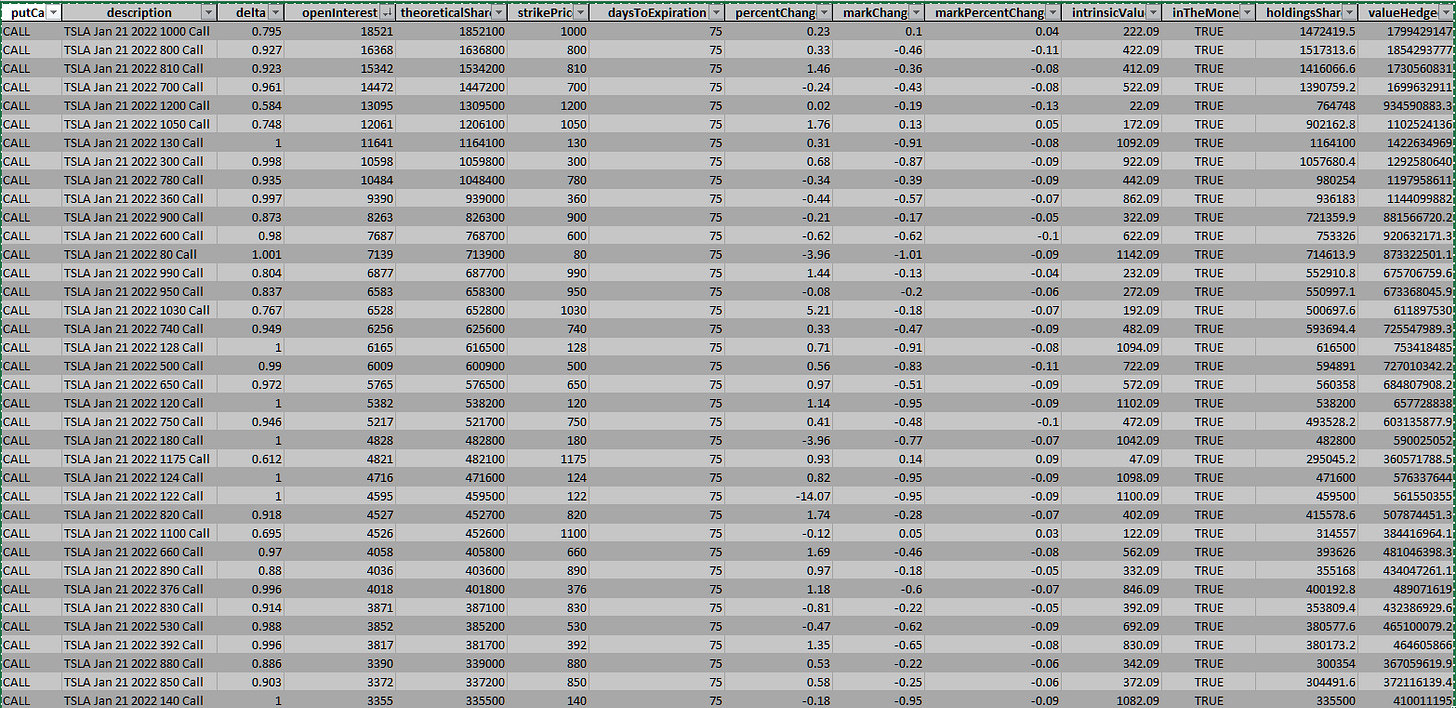

January 22 Call Holders

Right now you have 42M shares staked against in the money options for January 21 2022 Monthly Call Expirations. Many are deep in the money suggesting they were bought as Leaps possibly well over a year ago.

If you are sitting on the 1M + shares from the 80, 130, 300, 360 Calls…do you consider cashing in now?

Obviously there will be tax considerations…but given that over 4% of the company’s shares outstanding are pegged to the expiration price on one day…it’s feasible that some holder might be willing to take profits. Some may even consider taking profits right away before Elon has the chance to get out.

This also could of course move options holders with nearer expirations such as Nov and Dec Monthlies to also cut bait.

Final thoughts

Of course it’s feasible that Elon may be doing all of this as a ploy and somehow manages to lure and skewer short sellers once again through gamesmanship (tweets a potential partnership with Uber for robotaxis in 2050).

Having said all thought…I wonder what Gary Gensler thinks of all of this? If Elon doesn’t go through with this…could this be a construed as a misleading statement to investors?

Time will tell.

Suffice it to say…if Elon does shed 10% of his shares…I suspect it will move the stock at least 5% downwards…might be worth speculating on a put/volatility strategy for the next week or two.

He always keeps things interesting.