Dropbox -- Quarter in Review

Business as usual. Still looks undervalued.

Dropbox has released quarterly earnings. I’m going to try and start providing updates for a core number of stocks (probably between 10-15) based on their latest earnings reports.

Let’s start with the basics in our quarterly review of Dropbox. As my Twitter follower’s may have noted I’m starting to use more bar charts in my tweets, as I personally feel my investment improves when I can visualize the data as opposed to just seeing numbers on a spreadsheet.

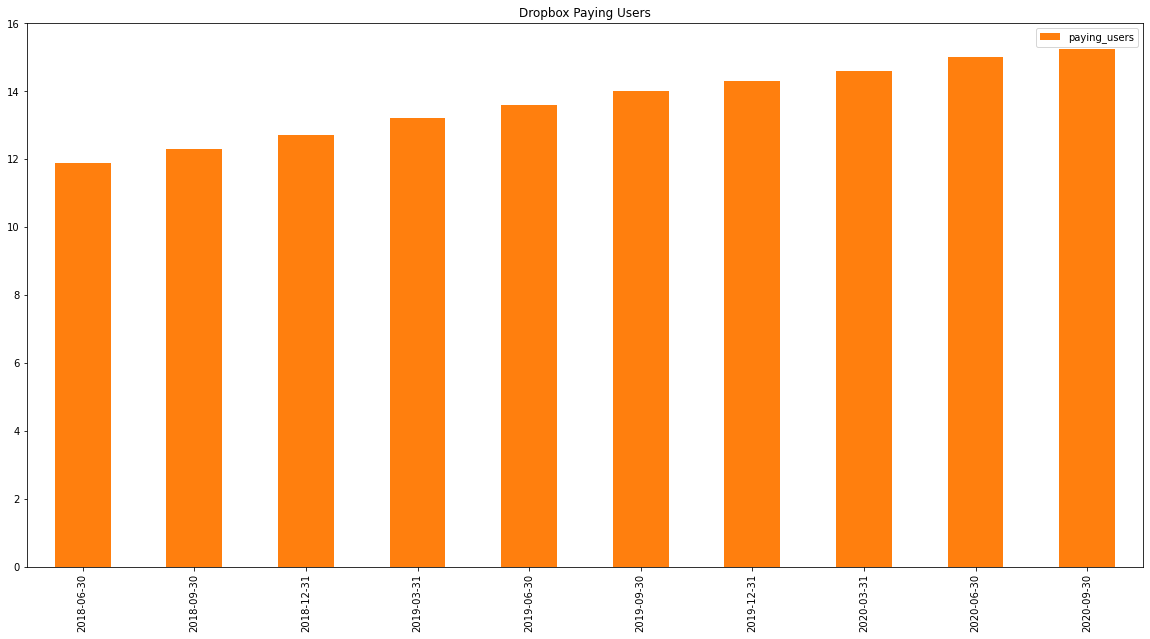

We’ll look first at paying users — they increased paying users pretty much on pace with what they’ve been doing. About 290k new users in the quarter, bringing them to about 15.25M paying users. Up about 1.25M in the past twelve months.

Moving on to revenues. Revenue came in at 487M, up 20M sequentially and up about 60M from the twelve month prior quarter. Company beat their guidance by about 3m. And they guided for next quarter at 498M at the midpoint. Implying sequential growth of 21M. I wonder if the new wave of lockdowns will move the needle on that at all. Especially if president elect Biden does in fact implement a nationwide shutdown to deal with the winter COVID-19 wave.

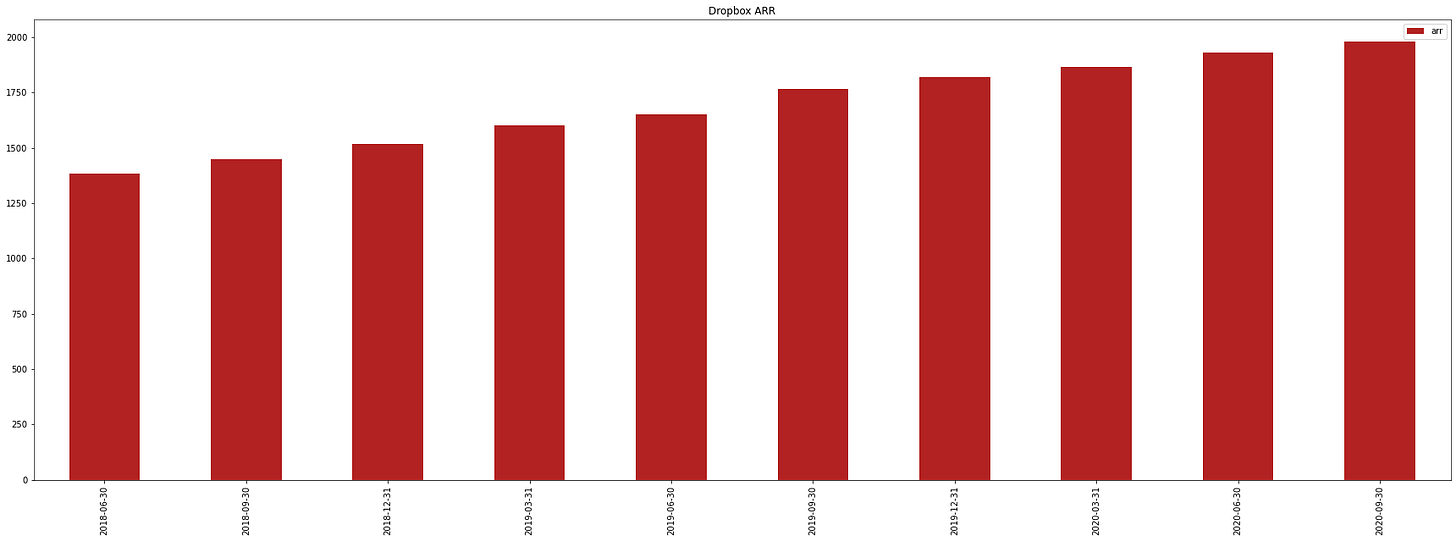

Ok now let’s take a look at our next chart. Annual Recurring Revenue. This a key metric for Dropbox and for every SaaS business as it helps you model out the base revenue assumptions for future growth. Here we see ARR continues to grow. They now have nearly 2B in Recurring Revenue!

Let’s look at Gross Margin.

GAAP Gross Margin was 78.8 in the quarter. Up .7% sequentially and 3.3% year over year. The company doesn’t provide gross margin, only Non GAAP Operating Margin. It seems realistic to believe that at some point Dropbox will have it’s margins over 80% especially as it moves to a distributed workforce and begins subletting it’s office space out (these costs are included in costs of revenue).

Now let’s look at some metrics. We will start with Average Revenue Per User. We see that ARPU is continuing it’s slow climb. It’s now at $128.03 per paying customer per year. Couple this with Dropbox’s improving margins and increasing customer count and you can certainly see why the company is projecting over 1B in Free Cash Flow by 2024.

As important as ARPU is, it’s also important to look at the acquisition costs to attain these customers. For my calculations I look at the difference in customers from the prior quarter and assume that marketing spend in the quarter was used to acquire these customers exclusively. You can certainly see that the expense this quarter was higher than previous quarters. You can also see that it is trending upwards indicating that they are having to work harder to get new customers.

However since we are assuming that all of the companies Sales and Marketing went into acquiring customers, we’ll also assume that all of it’s new Annual Recurring Revenue is exclusively the product of these customers. That way we are providing fair metrics on which we can judge the company. Here we see that it’s implied ARR per new customer is trending in the right direction over the past 3 quarters. This is a good sign but it’s worth watching to see if it continues to grow. I imagine it will as add on-products like HelloSign will inflate the ARR without increasing customers.

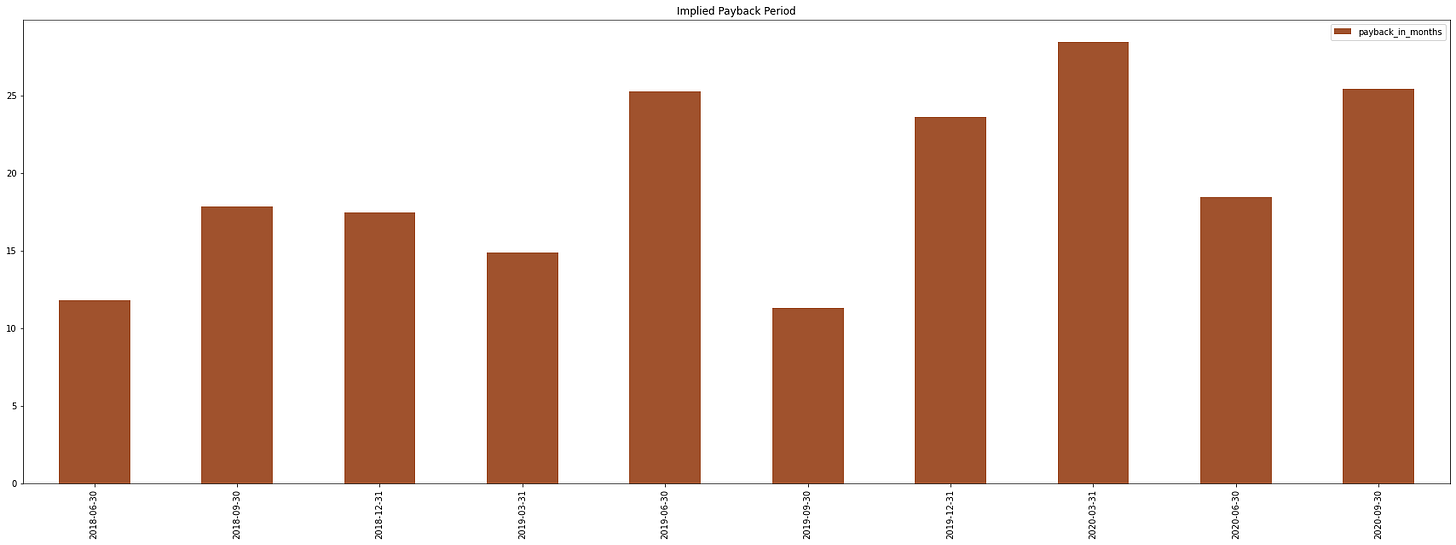

Finally let’s look at the payback period that this implies. I calculate payback by taking the implied ARR number, multiplying it by the gross margin and dividing it by 12. This gives me the monthly profit a new customer in the period will bring. We see that the payback period is within the companies historical trends, but we also see that over time it is getting longer. Based on my model the true payback period for last quarter was 32 months, or 11 quarters.

Personally I invest with a 1-3 year time span in mind, so I like companies that can generate returns on investments in less than 3 years. Dropbox is still doing this, but barely. That being said, I think this number bears watching as Dropbox doesn’t have the advantage of being an infrastructure that’s so integral within a company that it takes years to replace. As it adds on services and tools it may get to the point of being somewhat essential, but it isn’t there yet.

Finally let’s look at some valuation numbers.

It has an enterprise value of 7.5B dollars. If you assume an expect return of 7% on an investment as being a fair return, then your expected return in free cash flows is 525M dollars. Dropbox has 492M in free cash flow over the twelve trailing months.

Worth noting is share dilution. The share count increased by about .1%. When using FCF as a metric rather than net income, it’s worth tracking share dilution to make sure Stock Based Compensation expenses don’t erode your investment.

My Thesis:

My original investment thesis in Dropbox was based primarily on risk/reward and fair value. Nothing from this quarter has changed the basis for my thesis. I still view the company as undervalued. It has 600M total users. Only a small fraction of those are monetized. It’s recently announced a family plan which may help it to monetize more users. It also has just started incorporating HelloSign into it’s platform. While Docusign and Adobe certainly have the first mover advantage, on the call they said that HelloSign signups were up 45% in the quarter. It was integrated directly into the Dropbox platform in July. This quarter should really tell the story for how it does. I think the acquisition for less than 200M dollars will end up being a steal for Dropbox.

I still don’t see a scenario where the stock goes below $16 which was it’s March low. So the downside is possibly 10%. Looking at the upside, if the company returns 1B in FCF by 2024 then logically the value of the company could as much as double over the next 4 years, assuming share dilution remains where it has been. Not saying that it will double, but I do believe that at least an 11 EV/FCF ratio is a fair price to pay for a business with Dropbox’s margins. Using that would put Dropbox at an EV around 11B in 2024 which would be a near 50% upside on it’s current share price.

I still believe that a larger company would happily buy Dropbox outright for over 10B. So looking at the 50% upside reward, to the 10% downside risk, I’m happy to continue holding Dropbox. The quarter was business as usual. The market’s reaction was business as usual. I’m perfectly happy if they continue doing business as usual.