Domino's -- Slice 1

Not deep dish, a deep dive

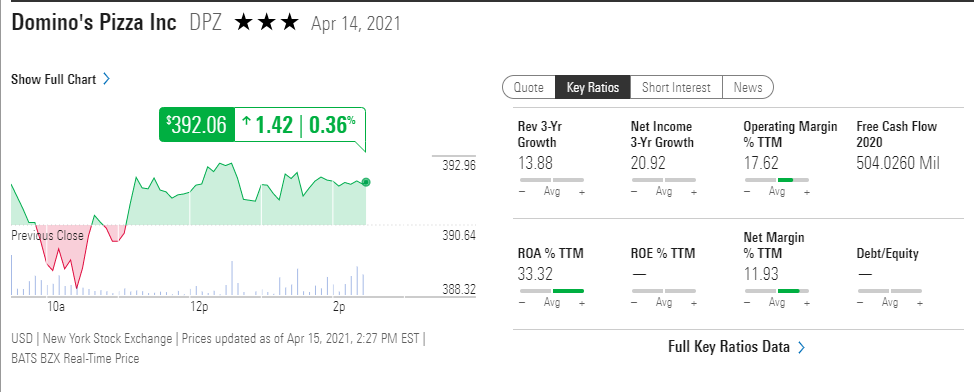

So over the past few weeks I’ve been getting back more into my traditional investor mindset and doing deeper looks into some interesting businesses. One which caught my eye was Domino’s. I was impressed by their return on assets, consistent growth and their fantastic stock performance. I wanted to know what makes Domino’s different from let’s say a Pizza Hut, or even a McDonald’s.

Per Morningstar, over the past 3 years, Domino’s revenues have grown 13.88%. Their Net Income has grown 21%. They have a 33% ROA. Those are great numbers. The simplest way of explaining how this business works is — intense leverage on great unit economics.

Over the next few weeks I’ll go over those unit economics and explain how Domino’s has built a business which is self sustaining, and then how management has leveraged that business model to provide incredible returns to investors. I’ll also go over why that leverage could be a risk, along with how Domino’s could fare in this new world of food platform aggregators like DoorDash and Uber Eats.

This week, I’ll go over the basics. Domino’s Franchise Model.

In investing we talk about secret sauce. It’s entirely appropriate then that a Pizza business has a fantastic secret sauce. For Domino’s the sauce is in the way they’ve built the business.

Domino’s has 6 different lines of business:

Domino’s Franchises - Handles US Franchising

Domino’s International Franchises - Seeks International Master Franchisers

Domino’s National Ad Fund - A Non Profit Corp that handles Advertising

Domino’s IP Holder - Handles all intellectual property

Domino’s Gift Cards - Manages the Gift Cards

Domino’s Pizza Distribution (DPD) - Provides Supplies and Equipment mandatory to be used in the store

Of these businesses most of us are familiar with the franchise part of the business. Domino’s doesn’t own it’s stores, it’s franchises them. However unlike most franchise businesses Domino’s has exceptionally high requirements for owning a franchise

Requirement 1. It must have an individual who owns 51% of the Business

Requirement 2. That individual must have spent at least 12 months as a supervisor/manager prior to owning a franchise

These two requirements are one of the essential elements of the Domino’s Model. They want experienced operators who are well qualified and likely to be successful as franchise operators. This is critical because Domino’s as a business is dependent on the success of it’s operators. So they create a model that really tries to put it’s operators in the best position possible to win.

For a franchise operator, a new franchise can cost between 75k to 185k in upfront start up costs. But in many cases the payback period on these franchises is around 3 years. That’s fast! By comparison a McDonald’s franchise can cost over 1M dollars to start! So by having lower start up costs, and more qualified operators, Domino’s strives to create a model which can expand and scale quickly.

In addition to the upfront costs, Domino’s franchises pay royalty fees and other fees. Those royalty other fees come in a number of forms.

There are two different fees which amount to essential 15% of gross sales (technically one is limited to a few menu items, but since it includes Pizza, I’m simplifying). These sales go to DPZ’s bottom lines.

The other fees are where the model gets interest. Domino’s has a 4% fee which goes straight to the non profit advertising subsidiary Domino’s National Ad Fund. Which as you can imagine is spent on national advertising. In 2019 they spent about 450M on national advertising. They also charge a variable amount up to 4% to certain stores for local cooperative advertising.

Domino’s stores pay a .26 per transaction fee for a “technology fee”, an annual software enhancement fee (was at $600 in 2019). As you can imagine these fees are used towards developing new technology for Domino’s stores. Domino’s has one of the most efficient operations among restaurants. They were a pioneer in online ordering, and have consistently re-invested in technology. Currently they are experimenting with robotic deliveries in Houston. I imagine that they will begin doing more with robotics in the kitchen to continue to reduce costs.

Of course deliveries is probably one of the areas of the business where the unit costs are most difficult. I’ll dig into that next time along with Domino’s Pizza Distribution, another core aspect of the model. But for now, here are the key takeaways.

1.) Domino’s doesn’t let a business set up franchises. It requires a majority individual owner to set up the franchise and take ownership. This person must have a year of experience running a Domino’s as an employee first.

2.) Domino’s model uses the fees charged to it’s franchises to cover both S&A, along with R&D expenses. This leaves the parent company only to have to deal with administrative and general expenses.

Next time I’ll look at how Domino’s uses it’s DPD to create a revenue share for it’s franchises and what are the implications of the new delivery apps like Uber Eats and Door Dash.

Hope you enjoyed this slice of the Domino’s Pizza Deep Dive Pie. I wanted to just a take a moment and give a shout out to Tegus Research. I’ve been using a free trial of their buyside research platform and I strongly suggest you do the same. It has transcripts of calls with different industry insiders, customers, former executives where they go in to details about a business, a market, a trend. The insights are actionable and will quickly give you conviction to make a decision about investing or not. For disclosure, I’m getting no compensation for this shout out. I just think it’s only fair to give them as much as exposure are possible, because I’ve really enjoyed my trial.