Capital Calls? Is SVB the Canary in the PE coal mine?

There is a bank run underway at Silicon Valley Bank. I decided to take a dig through the financials to understand whether anyone might be interested in stepping in to save it.

What we know?

Silicon Valley Bank surprised the market by announcing the liquidation of it’s available for sale portfolio at a loss along with a capital raise. These actions suggested a liquidity problem which has sparked a bank run. Unlike most banks, Silicon Valley Bank has a disproportionate amount of HNW (High Net Worth) clients, such as tech founders, VCs, and PE firms. The mechanism designed to prevent bank runs (FDIC) caps insurance at 250k, a paltry amount for billionaires.

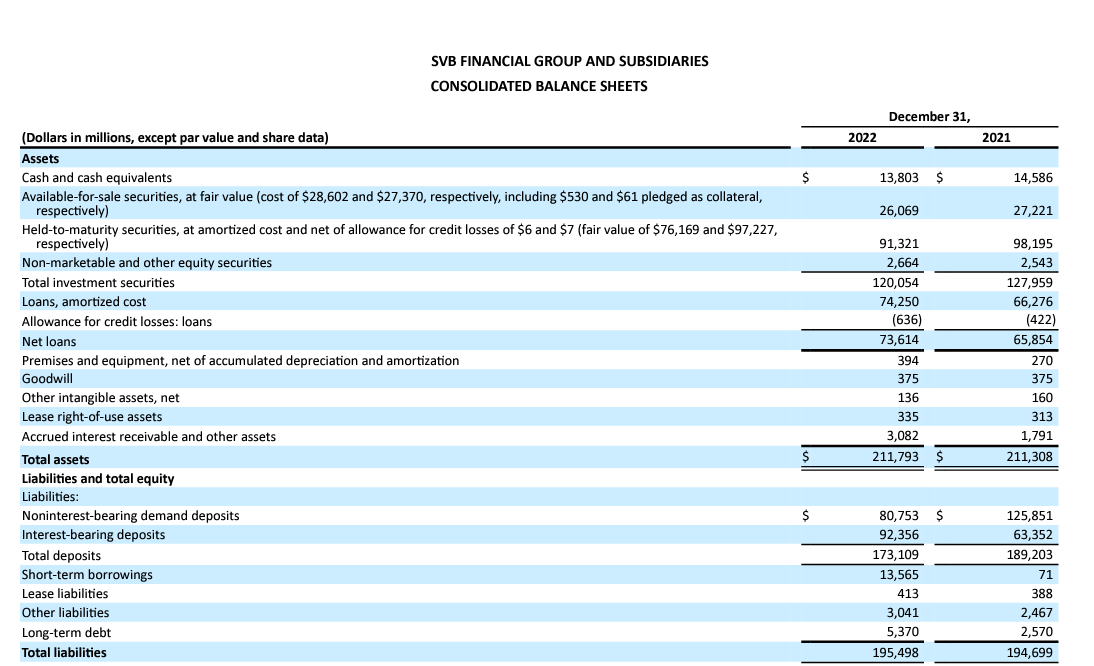

Balance Sheet

Prior to the bank run, as of year end SVB sat on 13B in cash. They had an available for sale portfolio of 26B (which they sold for 21B and recognized a 1.8B loss on, suggesting they had already been selling since December).

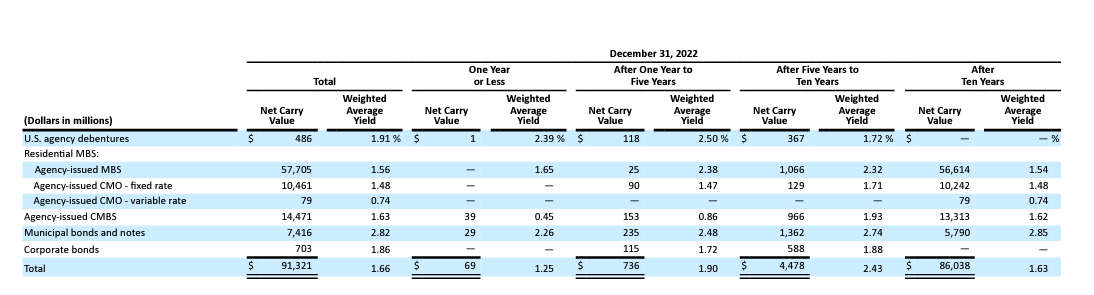

They also have held to maturity securities with a book value of 91B but a fair value of only 76B.

Of the “held-to-maturity” securities, 95% are over 10 years and the weighted average yield is 1.63. Given the rise in rates, the fair value of this has likely dropped closer to 70B.

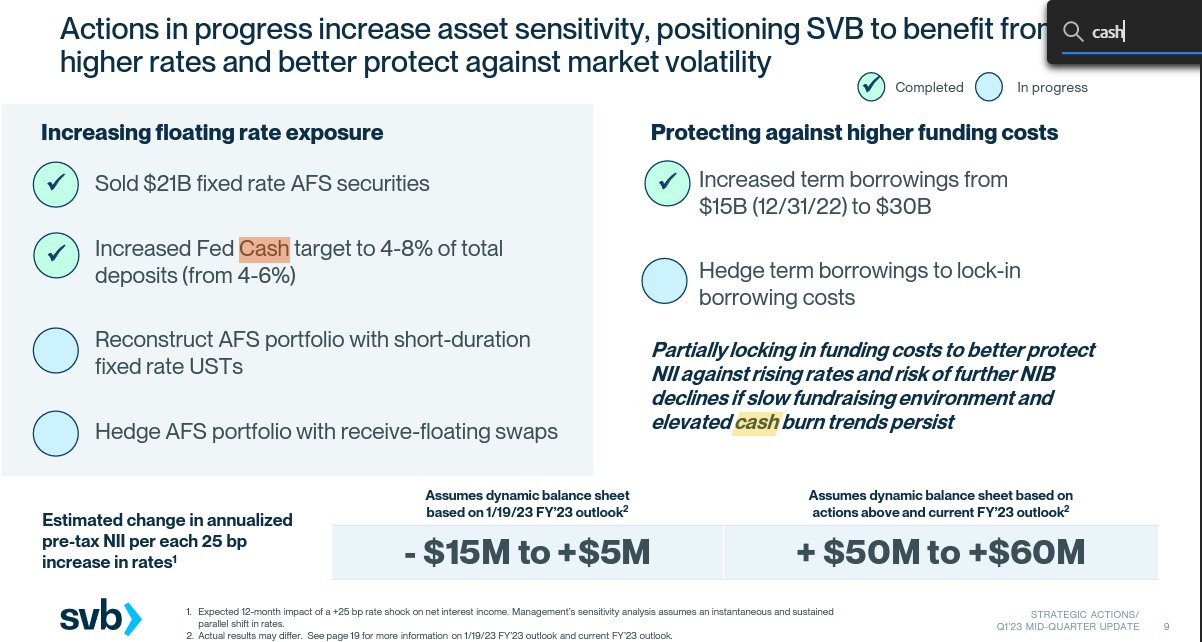

Term Borrowings

Another way they’ve added liquidity is by increasing term borrowings by 15B

Let’s do math!

13B in cash + 15B in borrowings + 21B proceeds from sales + 70B held to maturity securities.

119B in total liquidity (HTM isn’t really liquidity but we will pretend it is).

Deposits

Total deposits were 170B at year end.

That means they have a 50B shortfall in liquidity.

However they do have other long term assets

Other Assets

The bank has about 74B in loans valued at amortized cost on the balance sheet. So the key for any investor looking to step in here…what’s the long term value of these loans? Remember the Held to Maturity securities could offer a 25B payout that we aren’t accounting for if they could in fact hold them to maturity. This means the loan portfolio would need to be able to cover 25B in deposits and 30B in borrowings.

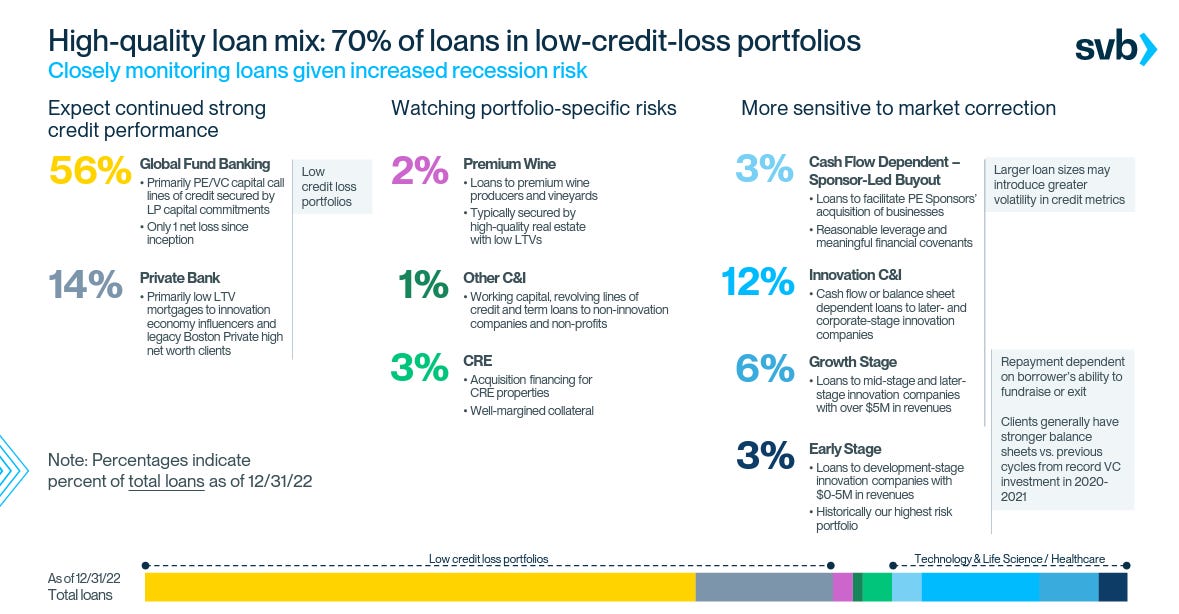

This is the makeup of the loan portfolio:

Lets focus on Global Fund Banking and Private Bank

From the 10-K.

Global Fund Banking (segment and class) – The vast majority of our GFB portfolio segment consists of capital call lines of credit, the repayment of which is dependent on the payment of capital calls by the underlying limited partner investors in funds managed by certain private equity and venture capital firms.

Private Bank (segment and class) – Loans to our Private Bank clients who are primarily private equity/venture capital professionals and executives in the innovation companies as well as high net worth clients acquired from Boston Private. We offer a customized suite of private banking services, including mortgages, home equity lines of credit, restricted and private stock loans, personal capital call lines of credit, lines of credit against liquid assets and other secured and unsecured lending products. In addition, we provide owner occupied commercial mortgages to Private Bank clients and real estate secured loans to eligible employees through our EHOP.

So Silicon Valley Bank is highly dependent upon capital calls for the repayment of loans. What is a capital call?

Investment funds are often structured as limited partnerships. The investors are limited partners and the general/managing partner is the fund manager. The investors commit to offer a certain amount of money when called upon to do so. This capital commitment is called as needed to fund investments.

Of course if those investors fail to pay up because of financial hardship or for some other reasons, the fund could find itself strapped for cash. Unless some bank had lent the fund in money in advance on the assumption that investors would always pay up…or at least that they could force payment via the legal system quickly…in this case well that bank would probably be in trouble. SVB is certainly in trouble. Considering the high valuation at which many of these funds were created, it’s unsurprising that investors aren’t willing to hand over their capital. Especially if the bank were to concentrate it’s loans in the hands of just a few clients…

Larger loans and syndicated loans. In addition, a significant portion of our loan portfolio is comprised of larger loans, which could increase the impact on us of any single borrower default. As of December 31, 2022, loans equal to or greater than $20 million to any single client (individually or in the aggregate) totaled $46.8 billion, or 63 percent of our portfolio. These larger loans have represented an increasing portion of our total loan portfolio over me. They include capital call lines of credit to our private equity and venture capital clients and SLBO loans, as well as other loans made to our later-stage and larger corporate clients, and that may be made to companies with greater levels of scale but also debt relative to their equity, balance sheet liquidity or cash flow. Additionally, we have continued our efforts to grow our loan portfolio by agenting or arranging larger syndicated credit facilities and participating in larger syndicates agented by other financial institutions. In those arrangements where we do not act as the lead syndicate agent, our control or decision-making ability over the credit facility is typically limited to our participation interest.

Conclusion

The bank run underway at SVB isn’t just about rising rates. Nor is it about the capital raise. What’s really going on is you have sophisticated fund managers who understand this business, and I suspect they can clearly tell that some of these capital call loans are going to default/be wrote down. Possibly because they themselves have struggled to get clients to pay the funds they committed.

Could SVB be saved? Yes. Is it worth it? Maybe. A buyer would need to have deep pockets, and the overhead to force investors to pay commitments. The equity value would also need to fall. This of course assumes that said investors can do so. Given the way some tech billionaires have seen their net worth cut in half, this may not be a possibility. My math suggests they would need to collect about 83% on the value of the loan portfolio to break even. This assumes that they don’t have to start selling HTM securities at a loss. If they have to start selling that portfolio then they are a goner unless the bank run stops or a buyer emerges.

I don’t believe a buyer emerges for more than 2B given that they will have 30B in debt on the balance sheet as a result of these actions.