AirBNB ($ABNB ) S-1/A Analysis

My final thoughts on the offering and the valuation

Hey everyone! 👋

AirBNB has release their S-1/A which means they are now giving the market an idea as to how they value their company. With this, I can now do a complete review of the IPO and give my thoughts as to valuation:

Before we begin if you haven’t, you may want to look at Part 1 and Part 2 of my analysis of the Risk Summaries included in the filing. If you don’t want to spend that much time reading, I’ll summarize my conclusions:

Basically the major risks to the business include COVID19’s impact on global travel, increasing competition and increasing government regulation.

After thinking long and hard about the risks, I’m not deterred by them. My reasoning is as follows:

COVID19 Risk

COVID19 has had a significant impact on travel. However LT it’s likely that the highest impacted segment of travel will be corporate travel. This likely will have a more significant impact on air travel and hotels. In fact, with more companies adopting a distributed workforce, it’s plausible that some employees will choose to live a nomadic life style leveraging available mid-term housing and choosing to work and explore. I find the LT impacts of COVID to be minimal at best and possibly even favorable for AirBNB.

Competition

While it’s true that AirBNB is facing increased competition from highly profitable operations like Google, Booking Holdings, Expedia, etc. the reality is AirBNB is still top of mind when it comes to the room/house sharing market. I don’t think this will change. The brand is established and internationally known. AirBNB is the common term used in multiple languages to refer to a shared room/house. The networking effects have established a sufficient enough moat to protect the core business from serious decay. Proof is in the 91% direct or unpaid traffic to AirBNB’s website.

Regulation

Simply put AirBNB puts money in the pockets of cities and municipalities via tourism and taxes. Whatever regulatory issues exist, AirBNB and the cities have a mutual interest in resolving them. Over-occupancy, bad guests and wild parties are not in the interest of any of the parties in these regulatory matters. Given the alignment of interests, I don’t see any reason why they won’t be able to overcome these hurdles.

Now let’s get to the valuation question. First, we’ll start with the valuation AirBNB is currently asking for:

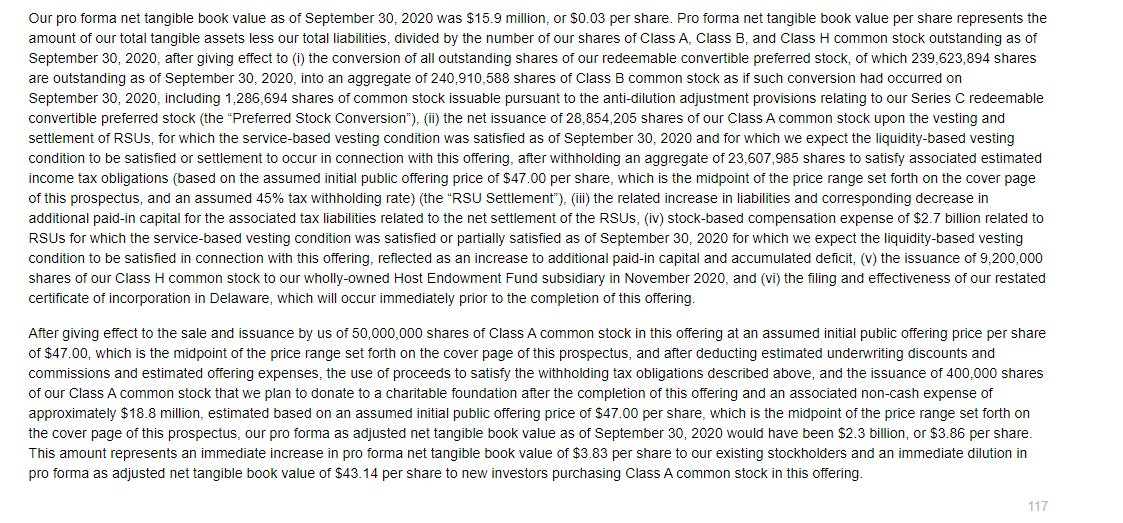

So total shares outstanding after this will be close to 600M shares. Midpoint price per share will be $47 per share. For simplified calculations these will serve as my base numbers for valuation.

This would give them a market cap of around 28B. However keep in mind that expenses for stock based compensation due to the IPO will be around 3B. The company forecasts an implied dilution of roughly 10%.

Now let’s look at the balance sheet:

Total Cash and Cash Equivalents is at 4.5B but is estimated to be at around 5.67B after the IPO

Total Cash equivalents are 2.5B. This implies a little over 3B in cash after the IPO.

Total Long Term Debt is 1.8B

Total commitments and obligations are 1.5B

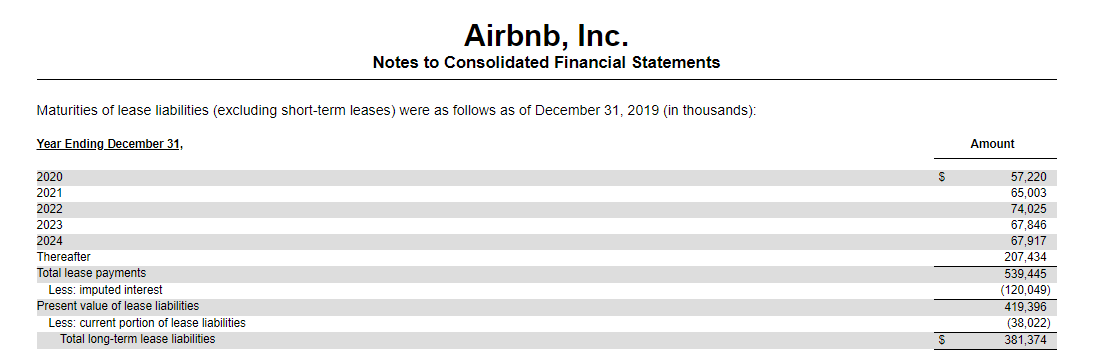

Lease obligations are .38B

I am going to adjusting the initial market cap to include the effects of dilution. Rather than using 28B, I will start with 31B which is essentially the valuation you will have to pay to get shares. After adding in the debt and obligations, then subtracting the cash and cash equivalents, I’d calculate the Enterprise Value of the Business to be in the neighborhood of 29B.

So this is more or less AirBNB’s valuation of their companies worth, right now.

Just a quick word on valuation. There are many ways to valuate a company. Ultimately the value of a company is the sum total of all expected future cash flows, discounted to some premium to reflect that these are future cash flows, and not present cash in hand. While I do believe that valuation should reflect the intrinsic value of a business, I do not subscribe to the DCF method.

Discounting cash flows makes assumptions not only about the business, but also about the broader economy as a whole. For example I could discount based on the risk free rate of the 10yr yield, or based on the return of the SP500. However those yields can vary wildly from my expectations.

For this reason I do my valuation based on what I believe to be a simpler method involving expected cash flows relative to the valuation.

Simply put, I expect the business to return a certain amount on my investment every year. My personal target is 7%. Slightly less than the broader stock market return, but much better than bonds and treasuries. I’m not going to concern myself with discounting for the future, because to be frank with the constant change in interest rates, it’s hard to say what really is the future value of money (the more they print, the less it’s worth).

So for a company with a market valuation of 29B. I expect that when mature it should be able to generate 7% yield on that valuation. In this case that would be 2B. I’m looking for a path to 2B in cash flows.

While it’s not a hard fast rule that it must yield 7%, I basically just want to see how realistic is the current market valuation. I’m well aware that market fluctuations and sentiment will ultimately give me an opportunity to make a profit on an investment, even if the valuation has a premium. I just want to make sure that the premium isn’t so enormous that on an intrinsic basis, there is no reasonable reason to believe that the company will ever meet it’s valuation. I’ll start by modeling what I believe to by AirBNB’s revenue at maturity.

Revenues:

I think to fairly evaluate AirBNB’s revenue you have to exclude COVID19 as you would a one time expense/revenue headwind/tailwind.

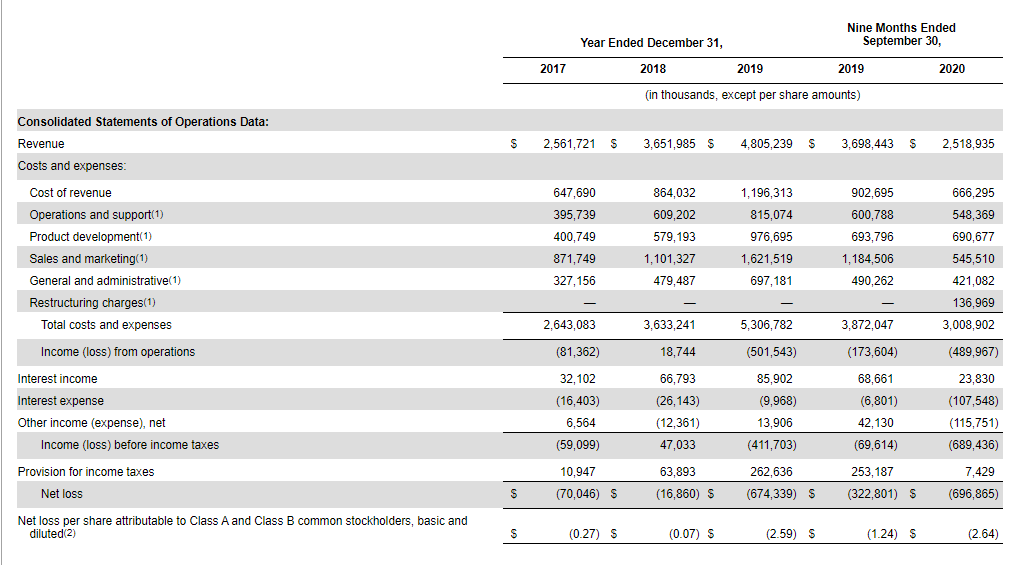

In FY19 AirBNB had 4.8B in revenues.

In FY20 prior to COVID related lockdowns in March and April you can see they had 24% and 15% YOY growth in GBV for January and February.

It’s likely that those numbers had been slightly impacted by COVID19 but obviously not to the extend that the March numbers were impacted.

When you look at total bookings, you see that prior to the lockdowns, AirBNB was still experiencing growth.

Rather than trying to extrapolate percentages, I prefer to look at absolute growth and use that to project how the company will grow revenues. Percentages are overly influenced by the size of previous results (i.e. bigger companies will post percentages that will be smaller due to sheer size). With absolute numbers, you get a better picture of whether absolute growth is increasing/decreasing or steady.

In looking at the absolute numbers, Nights Booked was growing at a rapid pace prior to COVID, but GBV growth had begin to level off. This is not surprising as it points to the fact that the market in higher value countries is now pretty close to mature. The growth is in international, which likely will come at a much lower gross value.

Based on the consistencies in the absolute value of growth in Gross Bookings, and on the consistency of the absolute revenue growth in the 2 fiscal years prior to COVID19, I feel safe in assuming that revenue growth on an absolute basis likely will be steady for the next few years. I’ll use 1.1B dollars which is about the amount of revenue growth that was seen in each of the 2 years prior to COVID19.

I also feel it’s safe to say that it can grow at this pace for at few years, and likely will continue to grow for some time afterward albeit at a slower basis. Based on the continuous growth in Nights Booked, it clearly has something left in the tank before revenue growth starts to decelerate. However I don’t want to be too aggressive in my assumptions:

I’m going to assume 4-5 years of total growth at 1.1B dollars in revenue growth per year, with no further growth afterwards. I feel this is a fair assumption based on the numbers I’ve seen. If you prefer percentage based growth…the projections would be:

Y1 - 23% growth to pre COVID numbers (5.9B)

Y2 - 18.6% growth (7B)

Y3 - 15.7% growth (8.1B)

Y4 - 13.5% growth (9.2B)

Y5 - 11.9% growth (10.3B)

This would take annual revenues based on pre-COVID numbers to 9.2B - 10.3B in revenues annually. I will use the midpoint of 9.75B

That is my expected annual revenue target for AirBNB when it hits maturity: 9.75B per year

As I stated earlier, for a business with a near 30B valuation I’d like to see a path to cash flows of at least 2B.

At a midpoint revenue of 9.75B, to get to 2B in cash flows I’d need to see a path to margins of around 20%

Margins

To figure out how the company can improve margins first I’ll look to management commentary to see where they expect spending to decrease. In the breakdown of results and operations management listed these areas as ones where they see LT opportunities to decrease spending:

Operations and Support

Sales and Marketing

Given that the management has also made significant cost cuts during COVID19, we can extrapolate some ideas as to where future margins could be improved:

Cost of Revenue (25%)

During and before COVID this consistently has been about 25% of revenue. I don’t expect this to change and neither does management.

Operations and Support (15%):

Prior to COVID operations and support made up between 15-17% of revenue. During COVID the cost has ballooned to 22%. I’d expect post COVID this will undoubtedly go back to being 15% or less of total revenue overtime.

Sales and Marketing (17%):

Prior to COVID this made up between 30 and 34% of spend. During COVID the cost shrank to 22%. I expect LT total ad spend likely will be between 15 and 20% of revenues.

Other Costs and Expenses

Product and Development (15%):

Prior to COVID this area was between 15 and 17%. It ballooned to 27% but I expect likely it will go back to 15% post COVID. Currently AirBNB is working on infrastructure changes to it’s platform which should be tackled now when the platform is experiencing less demand.

General and Administrative (12%):

Prior to COVID these costs fluctuated between 12 and 14% of revenue. It likely will stay there or decrease slightly as these costs include numerous legal and tax issues.

Based on these calculations, my initial forecast for margins is around 16% before interest and taxes. This would amount to around 1.57B in pretax earnings per year. My target was 2B, this is about 20% off my target. However I think it’s important to note that my margin projections are based of AirBNB’s current business model. Do I think AirBNB has higher margin opportunities that could get them to the hurdle? Yes I do.

The great thing about being a marketplace is that you can provide services to both buyers AND sellers. You can also then monetize both buyers and sellers. Right now AirBNB is only monetizing buyers (guests). When excluding processing costs, the take rate of AirBNB from hosts is only 1%. What opportunities does AirBNB have for monetization which I feel could provide a higher gross margin?

AirBNB professional services/management (Luckey)

Promoted Listings on Experiences and Homes

Experiences (higher take rate)

AirBNB party rentals/events

AirBNB for work (yes you can rent out workspaces for retreats)

AirBNB branded credit card

AirBNB annual preferred membership (almost like a time share)

Hotel Tonight

I could certainly see one or any combination of these offerings improving both top and bottom lines. So in short, I could certainly see a path for AirBNB to hit 2B in pre tax earnings per year. For a business valued at 29B, I think that’s a very fair return.

Conclusion

In the long term I believe AirBNB will bring in at least 10B in annual revenues and do it at close to a 20% pre-tax margin. For a public offering that values it on an enterprise basis at close to 30B I think this is fairly valued. Seemingly management has a number of levers remaining to pull outside of their core business which could increase both revenues and margins.

Based on the current market conditions, if I can add AirBNB to my portfolio at a price of less than $50 per share, I’d be happy to do so. At $56 per share I’d limit myself to opening a speculative position. I would not be inclined to pay more than $63 per share.